US Dollar Nose-Dives Unprecedentedly, Iran Rial Regains Value

Reported by HPMM Group according to Fars news ; The exchange rate of US dollar to Iran’s rial witnessed an almost 33% plunge on Monday after a new set of regulatory measures were put into effect by the Iranian Central Bank.

On Monday afternoon (Tehran local time), US dollar lost a record amount of its value on Iran’s black market which provides the foreign currency needed for at most 3 percent of trade inbound Iran. Comparing with the highest rate of US dollar to rial in the past couple of months, which was 21,000 rials for one dollar, it is even a record 43 percent of depreciation for the greenback against Iranian national currency.

The official exchange rate offered by the Central Bank of Iran (CBI) to those importing basic commodities and pharmaceuticals, is almost one-third of the current rate on the black market.

There are now three exchange rates in the country; one for importing basic commodities and pharmaceuticals, another one for importing goods other than necessary, and finally the rate on the black market for those trading hard currency.

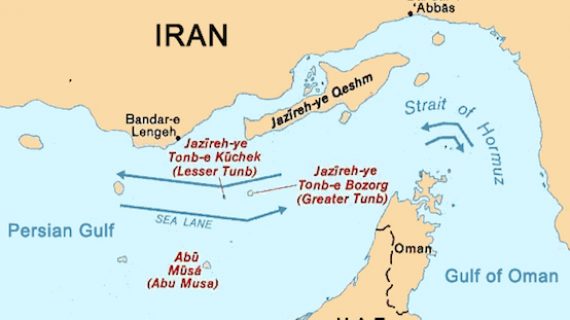

The greenback is offered at 42000 against Iranian national currency by the CBI; an exchange rate fixated by the Iranian Vice-President Eshaq Jahangiri, since April 9. The rate is between 75,000 and 80,000 rials for one US dollar in the secondary market. These two rates are used in almost 97 percent of commercial relations for importing foreign goods to Iran and they see none of the fluctuations, which according to Iranian intelligence reports are fanned by an anti-Iran economic alliance of the US, Saudi Arabia, and the UAE.

Foreign interference in Iran’s forex market sparked an untrue scarcity and frenzy on the demand side, intensifying the psychological hype in the public opinion perpetuating further increase in demand . After the US-led anti-Iran alliance gave consecutive shocks on the black market of foreign currencies in Iran, some middle-class people have been rushing to the black market to acquire small amounts of hard currency and therefore contributed to the artificial rise in demand. To many experts, the expectations of an increase in the rate in the future have been a big contributor to the soaring of rates on the black market in the past couple of months.

The protection unit of Iran’s economy ministry rolled out a report in mid-September recounting that the US state and treasury departments, in collaboration with the CIA, had put on agenda operations to stir chaos in Iran’s foreign currency market by inducing repeated shocks.

“Based on the collaboration plan among the US state and treasury departments and the CIA, an operational program is underway to stir chaos in Iran’s foreign currency market through inducing scheduled shocks to eventually destroy trust in the stability of rial value vis-à-vis the foreign currencies, by means of offices in some nearby states,” the report said.

It ensured that the investigation center of the economy ministry’s protection center have discovered and traced these operations, noting, “Most of the field agents active in Iran and used in this project are not aware that such an intelligence mechanism is underway by the US and see themselves as market profiteers who make gains by partnering in these transactions.”

The report said the aforementioned operation run by such US offices includes identifying rial origins and gates, funneling Iranians’ capital out of the country in the form of travellers’ cheque and through border areas.

Organization of a network of regional foreign currency agents with extensive interactions with Iran’s currency and liquidity market and sending groups with vast sums of Iranian rial to the bordering cities and even deep into the country to collect dollar from one hand, and bringing major foreign currency market profiteers into direct interaction with organized agents in meetings at the stated offices, on the other hand, are other parts of the measures adopted by the US state and treasury department as well as the CIA, the Iranian economy ministry’s protection center said.

Establishing market convergence among agents to concentrate shocks on the market, attempts to maintain the shock operations for 5 working days and funneling the collected foreign currencies out of the country in a move to disturb Iran’s economic system are among other joint measures adopted by the US state and treasury departments and the CIA in their operation to trigger disorder in Iran’s currency market, the report said.

Senior Iranian officials have attributed the currency market volatility to the enemies, saying, “The enemies are out to destroy the country’s assets and instill disappointment among the public.”

A sharp drop in rial’s value prompted a registration flurry of new companies which have reportedly received government dollars at concessionary prices for imports, but have sold them at inflated rates in the black market.

The situation arose after US President Donald Trump withdrew from May 2015 landmark nuclear deal with Iran and announced the most restrictive sanctions on the Islamic Republic.

The sanctions target Iran’s purchase of US dollars, its trade in gold and other precious metals as well as its automotive and aviation sectors.

Iranian officials have said US measures are tantamount to an “economic war”, but President Hassan Rouhani stressed in July that threats against Iran would have the opposite effect.

“Threats will further unite us; we will certainly defeat America,” he said, adding, “That will carry some costs for us, but the benefits will be greater.”