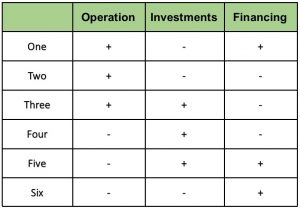

Where are you standing on Liquidity Matrix?

Liquidity Matrix

“Liquidity Matrix” is one of the most common instruments of cash flow analysis in companies. This matrix analyzes the cash flow in the company’s operations and evaluates the quality of the cash earned.

In fact the main and most important index to evaluate a company function is its cash flow. To run a thorough analysis of which the liquidity matrix pattern is used.

This matrix, which is derived from the cash flow statement of a company, often consists of 6 main different situations each of which is indicative of a certain feature in the company.

Situation one:

Operation +

Investments –

Financing +

Generally those companies which have a certain plan to enter the maturity or in some cases restart growth, follow this pattern. In this analysis every individual part has to be thoroughly analyzed. What is crucial here is being aware that although the company situation is ideal it can easily be lost unless we move wisely. In the company growth cycle this situation is equal to the maturity stage which can be prologue to downfall in case of negligence. In this period the company’s growth is ascending. (Company growth cycle)

Situation two:

Operation +

Investments –

Financing –

Most often when companies enter this situation, depending on the macro economy and the related industry of that company, if there is a capacity to grow, they should plan the strategies in a way that would help them retrieve situation one. One of the reasons to push businessmen to create holdings is helping them to achieve situation two.

Situation three:

Operation +

Investments +

Financing –

In this situation the surplus cash is either used to pay the liabilities or is divided between the shareholders. This is a time when companies are in need of structural change. This period is, in fact, the indicative of the time when a company has passed the maturity in the company growth cycle and is moving in a plateau. The biggest threat in this period is the decrease in the past investments’ added value. In this situation if effective financial strategies are not implemented the company will start to decline.

Situation four:

Operation –

Investments +

Financing –

In this situation the company’s current operation does not result in any cash flow. This is the time when the company starts selling either its assets or its operating investments. Now the company is facing cash shortage and should employ right methods to create operating cash flow as well as getting financed. Here if we calculate the Margin Indexes we will see that the operating and net profit margins are experiencing a negative rift. (Margin Indexes)

Situation five:

Operation –

Investments +

Financing +

In this situation the company keeps its operation going in hope of sustaining the current situation, or as a result of distinguishing new investment opportunities at least in hope of creating an opportunity to do so. Therefore, it resorts to financing through an increase in the capital. When a company is in this situation it means that its profit lacks proper quality.

Situation six:

Operation –

Investments –

Financing +

This situation happens under two circumstances:

- When the company has just been established.

- When the company is taking its first steps of exiting the situation five to enter situation one.

The fact that the company is in this situation is inherently neither positive nor negative. In fact situation six is our point zero. If the company has been recently established and that is the reason why the liquidity matrix shows situation six, the right strategies should be implemented to put the company in the right direction to enter growth and maturity stages. But if we are trying to exit situation five to start situation one, it is crucial to know that should we fail to inject liquidity promptly along with employing wise plans and strategies, our company will soon starts a decline.

When cash flow situation is recognized in a company, it is time to evaluate other financial metrics to identify the company’s objectives, to obtain which we need to analyze the company’s macro objectives. Do not forget that to choose the objectives, one of the most effective strategies is obtaining the industry average. Through this we will recognize our objective based on our field of industry and will develop right plans to achieve it.

Remember that:

- Situation six is our point zero and depending on what strategies are implemented afterwards can either help the company enter growth stage or result in its complete decline.

- Situations one, two and three are desirable. However, in all three we need to plan some strategies which would guarantee the company’s move forward and prevent its stagnancy. In short they need precautionary methods.

- Situations four and five are undesirable and unless effective strategies are not employed, the company’s decline is certain. In other words therapeutic considerations are required.

Your role:

Your role as the business owner, CFO, or a top manager, etc. consists of two parts:

- Applying the liquidity matrix, you should distinguish the company’s current situation and compare it with the desirable situation.

- With help of a financial management consultant develop right financial strategies to:

- Maintain the desirable situation if you already show situation one.

- Try to repeat the desirable situation if you are in situations two or three.

- Find a way to return to desirable situation if you are in situations four, five or six.