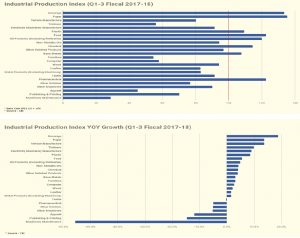

Iran’s IPI Rises 4.9 Percent

Motor vehicle, trailer and semi-trailer manufacturing industries’ gave the biggest boost to the Industrial Production Index

Reported by HPMM Group according to FINANCIAL TRIBUNE ; Most Iranian industries were on the path to growth during the three quarters of the previous fiscal year, but only a few accelerated enough to put recession behind them, according to the latest data on Industrial Production Index for large industrial units released by the Central Bank of Iran.

The nine-month period (March 21-Dec. 21, 2017) saw IPI grow 4.9% year-on-year to 102.5.

Each quarter also posted a healthy YOY growth. Q1 saw IPI rise 4.5%, then 5.3% in Q2 and finally 3.7% over the next three months.

IPI is an economic indicator measuring real output in various industries, with industrial production and capacity levels expressed as an index level relative to a base year, which CBI considers to be fiscal 2011-12, standing at 100.

In other words, the index does not express absolute production volumes or values, but the percentage change in production relative to that year.

The Central Bank of Iran calculates IPI using data on large industrial units with 100 workers or more operating in 24 industries.

The report indicates that 17 industrial groups posted YOY growth during the nine-month period. ‘Beverage Production’, with 18.9%, had the highest growth among all industries, followed by ‘motor vehicles, trailer and semi-trailer manufacturing industries’ with 13.8%, ‘paper production’ with 13.8%, ‘tobacco products’ with 9.9% and ‘plastic production’ with 8.6%.

Seven industries, on the other hand, were in negative territory with ‘maintenance and installation of machinery and equipment’ posting the steepest drop with a 55.6% YOY downturn. It was followed by ‘publishing and printing’ with 14.5%, ‘apparel manufacture’ with 11.9%, ‘production of other transportation vehicles’ with 5.1% and ‘pharmaceutical industry including chemical and plant-based drug production’ with 5%.

Furthermore, ‘pharmaceutical industry, including chemical and plant-based drug production’ had the most negative impact on the overall index, while ‘motor vehicle, trailer and semi-trailer manufacturing industries’ gave the biggest boost to the overall index.

> Grappling With Recession

Despite being in negative territory for nine months, three of the monitored industries, namely ‘computer and electronic products manufacture’, ‘textile’ and ‘apparel’ boosted their IPI in Q3.

The three grew 14.6%, 8.06% and 0.99% respectively in Q3, while being the in the red for the past two quarters.

Three other industries succumbed to recession in Q3 after moderate growth in the previous quarters. ‘Production of other transportation vehicles’ had the worst record with 29.1% drop, followed by ‘furniture industry’ with 12.6% downturn and ‘pharmaceuticals’ with 6.7% negative performance.

The industries truly ensnared by recession, however, are ‘maintenance and installation of machinery and equipment’, ‘printing and publishing’ and ‘machinery and equipment manufacture not listed elsewhere’.

The three dropped 46.6%, 30.3% and 3.8% in Q3 while contracting in the previous quarter. Yet, their uninterrupted nosedive has not affected the overall index much, as the three industries account for a meager share of value added affecting the index.