Iranian Billet Buyers Rush to Book Before US Sanctions Take Hold

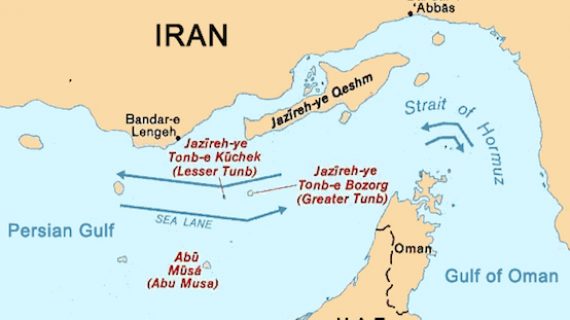

Buying activity in the Iranian export market for steel billet was lively in the week ended May 16 with customers rushing to place new orders for July-shipment material, especially those in the (Persian) Gulf Cooperation Council countries.

They feared that purchases with later delivery dates might be hindered by the threatened reimposition of sanctions against the Middle Eastern country after the US unilaterally reneged on an international nuclear deal it had signed with Iran and five world powers, Metal Bulletin reported.

US President Donald Trump announced his country’s withdrawal from the deal on May 8.

Companies that have dealings with Iran were allowed 90-180 days to discontinue them. At the end of this period, the US intends to reimpose its sanctions on Iran.

The US move has stirred up concerns among buyers of Iranian semi-finished steel products that the purchase of material from the country will be disrupted after July due to difficulties with banking transactions.

When the nuclear deal was first agreed in 2015, one result was that Iran was able to access the SWIFT telecommunications network that makes international banking transactions possible. Removal of this access would have significant effects on Iran’s ability to trade across borders.

“There are already almost no banks willing to work with Iran,” a trading source told Metal Bulletin.

Nevertheless, (P)GCC-based customers continued to book Iranian material this week. Several cargoes of Iran-origin billet were reported sold within the range of $490-503 per ton FOB.

Recent export billet offers from Iranian mills were heard at prices ranging from $500-510 per ton FOB.

In East and Southeast Asia, however, no billet bookings from Iran were heard done this week. South Korean customers were also refraining from deals with Iran. But some Indonesian and Thai buyers voiced their intention to continue buying from Iran because they do not have any links to the US.

Indonesian customers are currently only willing to accept the prices asked for Iranian material because products from other origins are too expensive.

Metal Bulletin’s weekly price assessment for Iranian billet exports was $490-503 per ton FOB on May 16, up from $495-505 per ton FOB a week earlier.

And the assessment for Iranian steel slab exports was $520-530 per ton FOB on May 16, against $535-540 per ton FOB a week earlier.

A 50,000-tonn cargo of Iranian slab was heard sold to Thailand within the range of $520-525 per ton FOB, but this information could not be confirmed at the time of publication.

Iran’s largest slab supplier, Mobarakeh Steel Company, has opened a slab tender expected to be closed on Friday. Recent offers from the mill were heard at $530 per ton FOB.

Market participants, however, did not expect transaction prices to exceed $520 per ton FOB because the material “has been overpriced recently and is softening now”.