Iran Railroad Expansion: Accomplishments, Grand Plans

With 7,500 km of railroads under construction, the declared goal is to extend the national railroad network from less than 15,000 kilometers at present to 25,000 kilometers by 2025

The share of rail cargo has increased from 8.5% to 12% in overall cargo volume from 2013 to 2017

Reported by HPMM Group according to FINANCIAL TRIBUNE ; In the last few years, Iran has demonstrated its strong political will to reemerge as a regional transportation hub.

The country’s efforts to improve its physical connectivity and become a centerpiece for regional supply-chains has been spearheaded by an ambitious development plan for the Iranian railroad sector that has been dubbed “Iran’s railroad revolution,” reads an article published in the German magazine Railway Technical Review (Eisenbahntechnische Rundschau). Excerpts follow:

With 7,500 km of railroads under construction, the declared goal is to extend the national railroad network from less than 15,000 kilometers at present to 25,000 kilometers by 2025.

According to the officials of Islamic Republic of Iran Railways, the expansion will not only produce almost 12,000 km of new railroad, but also considerable progress in the fields of electrification and double-track lines.

Iran’s Connectivity Agenda in 2017 Revisited

Like other oil-exporting states, Iran is seeking to reduce its heavy reliance on oil and gas exports by diversifying its economy.

Since President Hassan Rouhani took office in 2013, the Iranian railroad sector has profited immensely from government investments.

As a result, the share of rail cargo has increased from 8.5% to 12% in overall cargo volume from 2013 to 2017. IRIR sources expect it to rise even further, reaching a share of 30% by 2022.

The Iranian government has confirmed its determination to realize this rapid development by integrating railroad investments into its Sixth Five-Year Development Plan (2017-22).

In 2017, further progress was achieved in this sector. In January, the Iranian Parliament adopted a bill that allocates a fixed share of 1% of national oil-driven revenues to connectivity projects in the Iranian railroad sector.

In this context, Kheirollah Khademi, deputy minister of roads and urban development, said, “I believe we should do away with the oil-dependent economy and turn to transit-driven economy […] Transit can be a replacement for oil revenues.” Together with an additional multibillion USD funding stream for IRIR, the recent developments foreshadow a new era of railroad investment in Iran.

A potential roadblock to Iran’s connectivity vision is its lack of foreign investment flows, which have failed to reach anticipated levels after the relief of international sanctions in 2016. In its 10/2017 economic outlook for Iran, the World Bank highlights the absence of a complete integration of the Iranian banking sector into the international banking system and continued uncertainties regarding the full implementation of the Joint Comprehensive Plan of Action as the two main reasons for the shortfall in international investment.

In light of these challenges, the completion of the cross-border link from Astara in Azerbaijan to the namesake city in Iran in March 2017 is worth mentioning. The newly-constructed 82.5-meter-long dual-gauge (1,520 mm and 1,435 mm gauge) bridge over Astarachay River is the second rail border-crossing between the two countries.

The completion of this single project was of strategic importance for regional corridor developments. It is the first segment of the Qazvin-Rasht-Astara Railroad, a critical link in the International North-South Transport Corridor.

INSTC is an intermodal freight corridor that is mainly sponsored by India, Iran, Azerbaijan and Russia. Together with the Baku-Tbilisi-Kars Railroad, completed in October 2017, the Qazvin-Rasht-Astara Railroad will integrate Iran even further into the network of rail corridors that are being developed under the umbrella of China’s Belt and Road Initiative.

Strategic Context of Iran’s Corridor Development

In fact, the purpose of Iran’s rail sector development becomes much clearer with a view to its integration into a network of regional transport corridors.

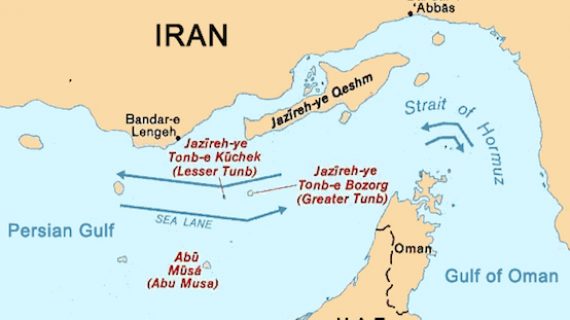

Iran’s geographic position offers potential corridor routings that could link the Persian Gulf and the Sea of Oman in its south with the landlocked Central Asian states, Russia, China and with Europe.

This is why China is channeling one of its six proposed BRI corridors, the so-called “China–Central Asia–West Asia Corridor”, through Iran. Chinese interests in Iran’s corridor development come along with visible investments into Iran’s rail infrastructure.

In July 2017, for example, China EximBank entered into a $1.5 billion loan agreement for financing the electrification of the 926-km Tehran-Mashhad main line, a project that will help increase the route’s maximum speed to up to 120 km/h for freight trains (250 km/h for passenger trains) and its yearly freight capacity to 10 million tons. Chinese companies, led by the China Railway Group Limited, are also constructing the 375-km-long Tehran-Qom-Isfahan high-speed railroad.

The landmark project of China’s engagement in Iran might be a high-speed connection from Urumqi to Iran, for which plans have first been proposed in 2015. During his Iran visit in 2016, Chinese President Xi Jinping announced that partly due to Chinese infrastructure investments, Sino-Iranian bilateral trade volume could increase tenfold in the next decade.

What adds to Iran’s importance for China’s BRI corridors is the fact that capacity limits have been reached at several cross-border bottlenecks on the northern routes of BRI.

Already in spring 2017, shortages at the border Malaszewicze/Brest (Belarus/ Poland) have been reported. According to different sources, between 50 and 100 trains from and to China cross this border every week. Together with the opening of the Baku-Tbilisi-Kars Railroad, such a capacity increases the strategic role of trans-Iranian rail corridors. At present, freight trains run from several cities in China to Tehran. They make use of two routings: a direct route via Kazakhstan, Uzbekistan and Turkmenistan and a recently opened route along the Caspian Sea (Uzen-Serhetyaka–Bereket–Etrek–Gorgan).

INSTC, the second emerging transport artery crossing Iran, is the second focal point of Iranian rail investments. The planned multimodal corridor is envisaged to connect Mumbai via shipping to Iranian ports in Chabahar and Bandar Abbas.

The northern part of the corridor will link Iran via Azerbaijan to Moscow. With the opening of the cross border bridge from Astara (Azerbaijan) to Astara (Iran) in 2017, INSTC gained new momentum.

Various other projects are underway in Iran that have the potential to boost new patterns of regional trade. For example, lines are being developed to connect Iran with Basra in Iraq and with Herat in Afghanistan.

Clearly, the country seeks to leverage its geostrategic position “at the crossroads of the East and the West”. Iran’s Minister of Roads and Urban Development Abbas Akhoundi has described his country’s ambition as an initiative to become the “the point of equilibrium in the region”.