Iran Capital Market Readiness For Expanding International Ties

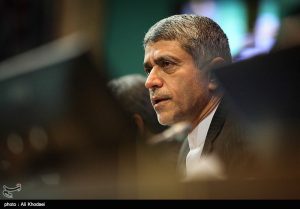

Reported by HPMM Group according to TASNIM ; In the twentieth Asia and Oceania Central Investment General Meeting (ACG20) opening speech, Ali Tayeb Nia pointing to capital market position said: all the members of Iran economic society including the capital market are ready to expand cooperation with economic organizations of other countries and welcome any constructive idea and new economic plans.

He went on to say that Iran, as the influential power of the region, has had remarkable progress in economy in recent years. He explained Iran’s achievements after JCPOA and added: in macroeconomics, while Iran’s growth rate was (-5.8%) and (-2.2%) in 2012 and 2013 respectively, after JCPOA, the country’s domestic gross production in the second three months of 2016 showed 4.4% incline comparing to the same period in the previous year, which can be a beginning for Iran economy blooming.

The economy minister highlighted Iran’s outstanding position in the region and said: Iran has turned to the biggest upcoming market not only in the Middle East but also in the world, which is rich with natural resources as well as educated and experienced human resources.

He then reiterated: after JCPOA Iran has turned into a country with minimum political risks which is a confirmation of it’s becoming an upcoming economic power.

Iran; a unique opportunity for foreign investors

Then the economy minister mentioned the incentive policies intended for the foreign investors and said: our incentives include legal, tax and regional ones.

In the legal incentives we will see a decrease in the time needed for foreign investments’ application and confirmation. For instance, investing in stock portfolio takes only 7 working days.

The minister counted the tax incentives as follows: 80% of the income of mineral and production units are exempted from tax for four years. Moreover, 100% of mineral and production units are exempted from tax for ten years.

He stated added: private and cooperative companies reinvestments with the objective of development, reconstruction and completion of mineral or industrial units are 50% exempted from tax. Also all companies accepted in the stock market whose share transitions are done through brokers are 10% exempted from tax.

Tayeb Nia pointed to foreign trade zones in Iran saying: all foreign trade zones are tax free for all economic activities in the first 20 years of their operation. In addition, limitless foreign investment possibility as well as waving visa and facilitating foreigners’ residence in Iran are other regional incentives.