Iran boosts oil exports in face of sanction threats

Iran’s oil exports hit 2.4 million barrels per day (mbpd) in May in what is seen as a new record since the lifting of international sanctions on Tehran in 2016, and despite the threats of returning US sanctions.

Reported by HPMM Group according to Press TV ; Based on the latest figures provided by Iran’s Ministry of Petroleum, the country also exported 300,000 barrels per day (bpd) of natural gas condensate.

Oil exports were clearly above the average of 2.1 mbpd recorded for the last Iranian calendar year (March 2017-2018).

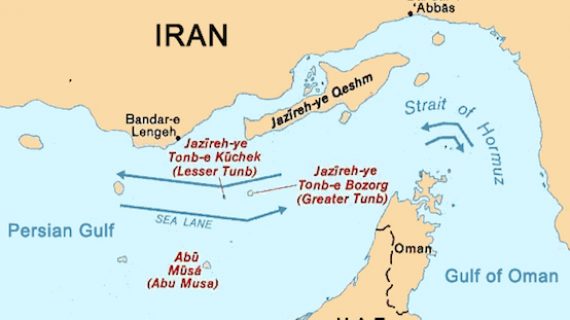

The bulk of Iran’s crude oil exports, at least 1.8 mbpd, goes to Asia. Most of the rest goes to Europe and these volumes are seen by analysts and traders as the more vulnerable to being curbed by US sanctions, according to a report by Reuters.

Iran expects a rise of 200,000 bpd in its production of condensate – a form of very light crude oil produced in association with natural gas – within the next few months when its Persian Gulf Start Refinery is fully developed. The country exports most of its condensate – which has a wide range of utilization in the petrochemical industry – to South Korea.

Other reports said Iran was selling its crude at an average of $77.4 per barrel. The figure was reported to have been registered for the week ending 25 May 2018.

Signs appeared earlier that showed certain refiners from Iran – one of Iran’s biggest oil importers – were trying to frontload their purchases from Iran ahead of a November US deadline for re-imposing sanctions on the country’s petroleum sector.

The India Times reported on Saturday that state refiner Bharat Petroleum Corp had requested an extra one million barrels of oil from the National Iranian Oil Company (NIOC) for June.

“At this point of time Iranian crude is attractive … it is faring better than spot cargoes and other crudes,” the India Times quoted an official in New Delhi as saying.

Iran has agreed to provide almost free shipping to Indian refiners in 2018/19, an incentive that significantly reduces the landed cost of Iranian oil compared to rival regional grades, it added.

India is Iran’s top oil client after China and was one of the few nations that continued to trade with Tehran during the previous round of US-led sanctions against Iran.