Impact of Trump’s irrational decisions on oil market

Reported by HPMM Group according to MEHR NEWS ; The Brent crude oil on Mon. for the first time in 2019, crossed the $71/barrel threshold, only hours after the US labelled Iran’s elite Islamic Revolutionary Guards Corps a ‘terrorist group’, indicating that the US president, contrary to his tweets, not only was uninterested in stabilizing the oil market and helping cut fuel prices in US, but also caused turmoil in the market with his illogical decisions.

US President Donald Trump has destabilized the oil market by his statements (or assaults) on the Organization of the Petroleum Exporting Countries (OPEC)’s policies; Trump’s statements, or interventions, on OPEC, following imposition of sanctions on Iran, went so far as to call on the Saudi king, in a belittling tone, to ramp up the kingdom’s oil output to offset removal of Iran’s oil from the market, and in June last year, when the market was stable in terms of supply and demand, called for OPEC’s increased output, which destabilized the oil market.

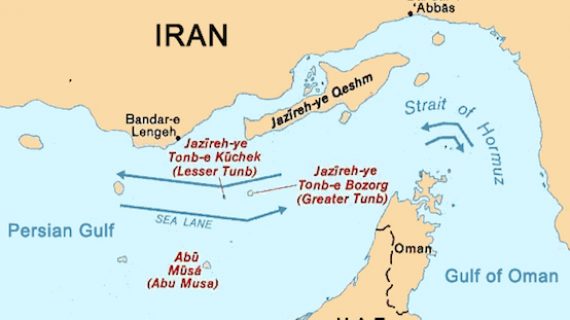

On Monday, April 8, Brent oil prices, influenced by sanctions on Iran and Venezuela, as two founding members of OPEC, recent Libyan clashes and OPEC’s reduced oil output, reached its highest level in the last five months. Brent crude was traded at $71.19/b and West Texas Intermediate (WTI) was priced at $64.44/b. International analysts say the main reason for rising oil prices is US sanctions against Iran and OPEC’s oil production cuts.

An agreement for a 1.2 mbd reduction in OPEC+ crude oil output was enforced on January 1, 2019, and is being well complied with by OPEC members, which has brought about Trump’s anger, who in February 2019, warned OPEC once again on his Twitter account not to continue reducing supplies and aggravate the price hikes.

On the other hand, OPEC is determined to implement the output cut agreement. They have not forgotten how the outcome of the last agreement (January 2017) was lost due to the collaboration of some members with Trump in a short time (two months) and the average OPEC crude price fell from $83/b to $63/b. certainly, OPEC members would not opt for the repeat of this experience.

Now that Nigeria and Libya are crisis-stricken, Venezuelan oil production has almost flatlined, and OPEC and its allies are determined to stick to their output cut plan, Trump’s call on oil consumers not to deal with Iran and putting pressure on its customers is self-injury which will lead to a sharp increase in oil prices, and eventually the American consumers will have to pay for it in gas and fuel stations because of the unilateralism of Mr. Trump.

The United States fully understands that elimination of Iran’s oil from the market would not benefit anyone and that countries like Saudi Arabia and the UAE do not have the ability to replace Iran’s oil (due to its special characteristics). According to international analysts, disruptions in supply conditions could push oil prices to over $80 per barrel.