German Companies Seek Ways to Keep Doing Business With Iran

Around 1,000 German Mittelstand firms have business ties to Iran and 130 firms have set up branches in Iran

Patrizia Melfi, director of the international competence center for six regional Volksbanken that have specialized in transactions with difficult countries, said they would continue to process transactions from Iran

Reported by HPMM Group according to FINANCIAL TRIBUNE ; Germany’s small-to-medium-sized firms, or Mittelstand, are scrambling to work out how to maintain business in Iran after a meeting between Germany’s foreign minister and his US counterpart dashed any hopes of a breakthrough on the nuclear accord.

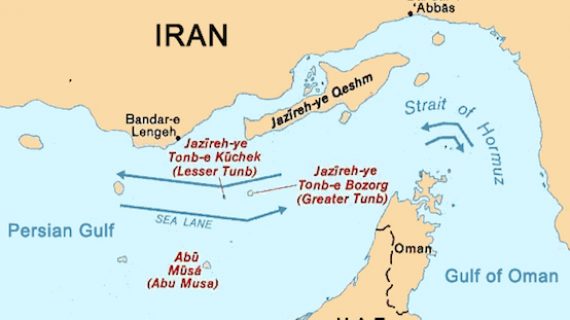

US Secretary of State Mike Pompeo has threatened to impose the “strongest sanctions in history” against Iran after US President Donald Trump pulled out of the Iran nuclear deal this month.

Faced with the prospect of being blacklisted by the United States if they defy sanctions, many German companies are awaiting guidance from Berlin about how they can honor contracts and continue financing operations in the Islamic Republic.

Around 1,000 German Mittelstand firms have business ties to Iran and 130 firms have set up branches in the country. They are now faced with “draconian penalties” if they breach sanctions, said Mario Ohoven, president of the German Association for Small- and Medium-Sized firms, Reuters reported.

Even companies that don’t have direct US business ties could be put on a blacklist for breaching secondary sanctions. This would prevent them from doing business with US companies, for example receiving shipments from the United States, said Philipp Andree, an Iran expert at Germany’s DIHK Chambers of Industries and Commerce.

German steel plant maker SMS Group signed a $400 million deal in February last year to expand the capacity of an Iranian steel plant. However, it has put its plans on ice and is wrapping up its business in the country.

A German software company, which has struck a cooperation partnership in Iran, said it was trying to work out how to honor its contracts while not annoying its partners in the United States.

“We are seeking dialogue with German politicians. On the one hand, we want to fulfill our contracts, but on the other hand cannot afford to violate US commercial demands,” said the manager who did not wish his company to be identified.

As well as issues around money transfers, the sharp depreciation in the Iranian rial posed a problem, he added.

German Foreign Minister Heiko Maas said after meeting Pompeo on Wednesday that there was no compromise in sight, underscoring the deep divisions that remain between the United States and Europe, which wants to keep the nuclear deal alive.

BFB Pharma Handel GmbH, an exporter of nutritional supplements that has been active in Iran for 14 years and does most of its business with the country, said it started facing difficulties last year.

“We are a very small company and we depend of course on monthly money transfers. When there is no money coming, one can become insolvent,” said Chief Executive Manutschehr Bonehie.

“Many companies are suffering from this. The government should find a way for Mittelstand companies.”

> “Blunt Sword”

Having been stung by US penalties in the past for busting US sanctions, Germany’s largest banks with operations in the United States, have shied away from financing business with Iran, leaving it up to smaller credit unions and the European-Iranian Trade Bank to transfer funds.

But, in a blow to many smaller exporters, DZ bank, the umbrella organization of German cooperative bank chain Raiffeisen-Volksbanken, said last week it would suspend financial transactions with Iran on July 1.

Patrizia Melfi, director of the international competence center for six regional Volksbanken that have specialized in transactions with difficult countries, said they would continue to process transactions from Iran.

But she said a problem could arise if Iran is cut off from the global payments network SWIFT.

“One solution could be for the Iranian central bank to transfer the money to an account at the Bundesbank (German central bank) from which it could then go to individual firms,” she said.

Last week, the European Commission proposed that EU governments make direct money transfers to Iran’s central bank to avoid US penalties to bypass the US financial system.

It has also suggested renewing a sanctions-blocking measure to protect European businesses in Iran.

Ohoven of the German Association for Small- and Medium-Sized Firms said the blocking statue was a “blunt sword” and it would make more sense to lobby at the US Office of Foreign Assets Control to ensure financing channels remained open for business with Iran.

Germany’s cultural and commercial ties with Iran date back to the 19th century.

Some Mittelstand firms remain sanguine about business prospects for the time being.

“Eleven German companies plan to travel to the Iran Health trade fair in Tehran in June,” said Jennifer Goldenstede, the head of foreign trade and export promotion, at high-tech industry association Spectaris.

“I think they will use the trade fair as an opportunity to get a handle on the situation and speak to traders,” she said.