How to apply Margin Indexes in financial management?

What are Margin Indexes?

The Margin Indexes show the relationship between profit and sale level in a company and are generally calculated for two purposes:

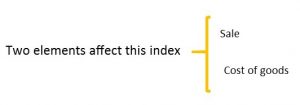

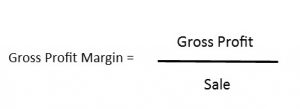

Gross Margin Result:

This index shows your net profit for every Dollar you make.

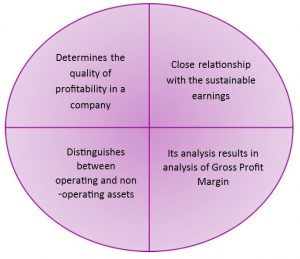

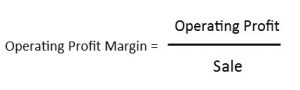

Operating Margin Result

This index is the most important member of Margin Indexes for four reasons:

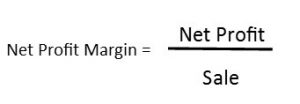

Net Margin Result:

Sustainable and unsustainable elements of profit are embedded in this index.

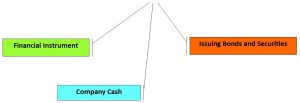

We separate sustainable and unsustainable profits by this index. Separating sustainable and unsustainable profits are important in analyzing company’s financial structure. This leads to determining what fraction of financing is being supplied through each of the methods mentioned below:

The more a company uses external financial leverage the wider the difference between operating and net profits. Generally speaking getting financed is desirable under the condition that it results in investments and increase of operating profit. Anyway, there has to be a limit to it.

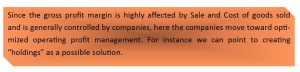

If Gross Profit Margin experiences many changes and moves toward decline we must:

- Pay attention to cost management since gross profit is the result of subtracting the cost of goods sold from the gross sale. As a result cost of goods sold should be analyzed with regard to these elements:

- Cost of goods sold consists of three elements, raw material, salaries and wages, and manufacturing overhead costs. These elements should be studied closely individually.

- For example for raw material, the amount of material used, or the amount of waste products, or the material costs are important.

- Needless to say that cost of goods sold in each industry and the company’s place in that industry might be different. Thus the level of dependence of any industry on any of them varies.

- Along with cost of goods sold, sale strategies should be taken care of too:

- Is it possible to either decrease cost or increase sale? Or should we consider completion of the value chain in the company?

- Through this analysis we can determine what risk factors exist in the company and by controlling these factors we can obtain sustainable profit.

By analyzing the Operating Profit Margin we can realize which company’s assets are not operating and do not bring any added value and should leave the company operation process cycle so that we can import cash in to the system. This is important especially because many companies are dealing with lack of liquidity at present.

Besides we should know that the definition of operating assets is different in each industry. For example in banking “Cash” is an operating asset.

All the operations in the company result in net profit which can be a combination of sustainable and unsustainable profit and subsequently we can determine our sustainable profit through further analysis.

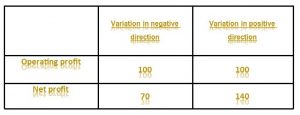

The more distance, in either positive or negative direction, the operating profit acquires from the net profit, the more unsustainable the net profit is. Therefore the variation between these two is crucial asking for specific concentration and engineering.

We probably can claim that one of margin indexes’ functions is their impressionability from financing methods applied in the company since any company’s financial structure has a remarkable effect on net profit margin due to its function of creating expenses. And this indicates a fracture between operating profit margin and net profit margin. As a result we have to determine what resulted in this method of financing.

To do so we need to:

- Compare each year’s financial statements with those of last 3 to 5 years.

- Pay attention to the industry mean in the capital market in our analysis

- Analyze the financial statements based on the value of the day to do a thorough research. Since financial statements are generally prepared based on costs on the date of production.