Why 1396 (2017) is a challenging year for Iranian business owners?

Tax forms one of the most challenging aspects of any business owner’s professional life. That is why lots of effort is put in preparing all the financial documents. However, as Iran had had an oil-dependent economy so far, Iranians had not got to experience the same share of tax pressure as other people all over the world do. But the government in Iran has started a move toward a non-oil-dependent economy which has already resulted in a dramatic change in tax regulations in 1395 (2016-2017). So far business owners could have still managed their financial and tax issues if they had had a limited accounting knowledge. But from this year on, considering all the changes the government administration made in tax regulations, all businesses will be needing some professionals to make sure that their financial matters are done meticulously. Otherwise they are bound to undergo extra taxes and even possibly fines.

It is noteworthy that each year’s budgeting plan, submitted to the parliament by the administration, plays a crucial role in tax policies of that year. A year in which the administration has announced the income of selling oil as its main financial source is naturally a better year taxwise and vice-versa. Now may seems a bit too soon to make any anticipations about taxes in the next year but the budgeting plan for 1396 speaks for itself.

The annual budgeting plan is the image of what economical rout the administration is going to pursue. The fact that what exactly each individual income is going to be used for is of utmost importance. Going through all parts of the budgeting plan will be rather complicated but instead we can discuss only the parts which concerns tax payers.

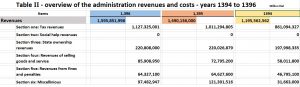

In the beginning let’s have a look at Iran’s budget plan for the three years ( 1394- 1395- 1396) to get a holistic sense:

As you can see the budget is financed through 6 main sources:

- Revenues

- Selling capital assets

- Selling financial assets

- Special revenues

- State corporate, state organizations and banks resources

- Subtracting the amounts which are included twice

The objective of this article is studying the administration’s revenues and specifically the revenue made through taxes.

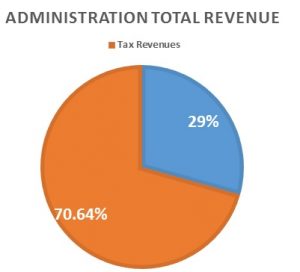

Regarding the change in the administration’s tendency to use taxation as its main revenue source instead of oil, which is totally noticeable in 1396 budget project, and also the current economy depression, business owners are going to take a hard blow in the coming year. Looking at table II shows that 70.64% of the administration revenue is going to be secures through taxation.

What is obvious is the fact that if the government wants to execute the 1396 budget project effectively, it is left with no choice but to be really strict with tax regulations. Ambiguous seasonal statements, lack of documentation for VAT, and negligence of following the new tax regulations including tax fines, thoroughly, all can bring about hazards and challenges for business owners. Challenges which may be impossible to anticipate by businessmen or even inexperience financial experts.

There are two groups who can survive this economy era. The first are those who have thorough financial strategy or use financial advisors’ services. The other are those with huge financial resources to count on. However, the SME business owners should be alert that to survive this new challenge, they need new and unconventional strategies.

During depression, it is necessary to have some considerations like:

- Thorough and purposeful planning

- Auditing the process while executing them

- Using financial experts’ services

All these is because one wrong move may result in a total decline.

On the other hand the new tax regulations, which were effective from the beginning of 1395, asks for aligning business matters with new laws. Failing to do so can result in many fines and penalties in this far-from-ideal economy situation.

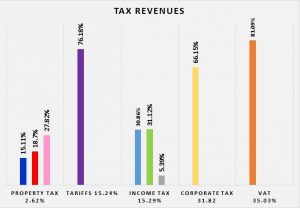

Looking at the 5 sections on the government revenue for 1396 and also each section’s share of tax revenue provision, we can easily see what the administration’s prediction of tax revenue from both state and private organizations is. The mentioned distribution is shown in the graph below:

- Property tax 2.62%

- Tariffs 15.24%

- Income tax 15.29%

- Corporate tax 31.82%

- VAT s 35.03%

As shown the biggest portion of the government revenue of state and private organizations is provided by VATs, corporate tax and income tax which are respectively the first, the second and the third. All these sections add up to 82.14% of 1396 government revenue combined together.

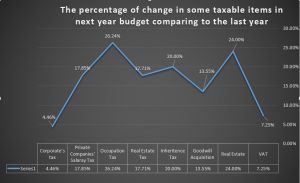

Regarding all the numbers and figures in 1396 budget, we see an increase in tax revenue of the country in all aspects comparing with 1395. As can be seen in the graph below, all the goods have shown a positive grow in tax comparing to last year.

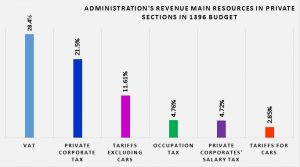

In a closer look you can see exactly what percentage of the government’s revenue is provided by taxes obtained from private organizations and businesses. The graph below shows the distribution of the government revenue from private businesses taxation.

As shown VAT, private corporate tax, and Tariffs with 28.4%, 21.5% and 14.46% are respectively the first three main revenue providers for government.

Conclusion:

Moving from an oil-dependent economy towards a tax-dependent one is inherently an effective and wise step for our country which can result in flourishing in domestic industry and business. However, during this change, like any other, we have to go through a transitional period. This period has certain characteristics which are not necessarily desirable. For example:

- Compulsory experience of depression which stems from lack of liquidity due to change in financial resources.

- Undergoing much taxation pressure for taxes which could have easily been avoided before this. Not because these taxes had been anticipated in the regulations but since the real revenue entered the economy in the form oil money so the need for them was not very noticeable.

- Mandatory tax fines and penalties which could have been forgiven before this.

This era, like any other era of dramatic change, does not necessarily result in decline, in fact if we take the right perspective it can even become the source of growth and consistency. To tackle this period we only have to identify old ways and replace them with new strategies some of which are easily achievable. Among them some are worth mentioning, like:

- Using financial experts’ services to prevent paying unnecessary tax or avoiding fines and penalties.

- Moving from conventional person-oriented management towards modern, team-oriented management. This requires fundamental change in planning systems, needs assessment and strategic planning.

- Outsourcing a part of financial matters in order to benefit from financial experts and reducing time and financial costs.

- Moving towards transparency, thorough documentation and in short using a systematic approach in accounting and financial issues.

Remember that a new challenge can become a platform for improvement by making some efforts.

Mohammad Ahmadi